How to make changes to recurring or one-time payments in GoCo Embedded payroll

Making changes before payroll processing can be done either as a one-off adjustment or as a recurring change.

One-off changes (to show up on the current payroll you are processing)

Earnings/Deductions

- After you click "Start Pay-run", you'll be taken to a grid of all employees. Please find the employee you'd like to make a one-off change for. A sidebar will pop up allowing you to add in earnings/non-native deductions from the drop-down menu. You will also be able to override the amounts that are in there.

- If your employee has multiple jobs and need to be paid for both jobs during a pay run, you can add the regular pay attached to the job from this sidebar!

Examples of one-off earnings: bonus, commissions, tips cash, overtime, etc and you can customize these categories at any time.There should not be a need to make updates to deductions for the benefits stored in GoCo (health, dental, vision, life, etc.). GoCo should automatically recognize life events and catch-up deductions and should prompt you about these. If another scenario comes up, please get in touch with your CSM.

⚠️ Please remember making changes in this module will not carry over into the next period, this is a one-off change.

‼️ Negative amounts cannot be entered. Please email us if you need to make that adjustment.Don't see a category for the type of earning/deduction you need? Email us at support@goco.io

Recurring changes (to show up on every payroll)

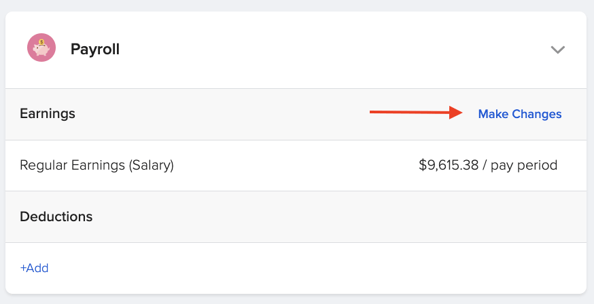

Earnings

- GoCo has a Payroll card that is on each employee's profile. If you want to create/adjust a recurring earning, you can do so by clicking "Make Changes" and going through the wizard.

- Examples of recurring earnings could be a bonus, car stipend, cell phone stipend, etc.

- Please remember that making changes in this module will carry the earnings into every pay period.

Benefit Deductions & Company Contributions

- If the deduction is stored in GoCo (health, dental, vision, life, etc.), you should not typically need to change the standard, ongoing deduction. If you have a life event, the deduction will automatically update.

- In the event you do need to update a deduction, on the employee's slide out, find the deduction and click the pencil icon to make the edit. This new deduction entered will only be effective during this pay run.

- If the deduction is in a Needs Review state, you cannot edit until you determine whether the deduction should have a catch-up added or the standard deduction used.

- If the catch-up is selected, you will not be able to edit the deduction in the pay grid.

- If the standard deduction is selected, you will be able to edit the deduction in the pay grid.

- If the deduction is not stored in GoCo, follow this article for guidance.

If you have any other questions please email us at support@goco.io 💚