How to add Offline 401K Deductions in GoCo

In GoCo, an offline deduction is any deduction that is not auto-calculated with our benefits module. A common example is 401(k), but the possibilities are endless!

Adding a one-time offline deduction:

- Start your payroll in GoCo

- Click on the employee you want to add a one-off deduction for

- Under deductions, select the dropdown for the type of deduction you want to add

Note: You cannot add/edit a % value, only dollar amounts

- Add in the dollar amount and save.

Adding recurring offline deductions:

- Login to GoCo and navigate to the employee you want to add an offline deduction for.

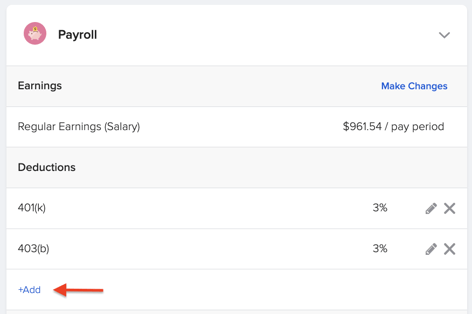

- Click on the employee's "Payroll" card

- Once it expands, you will see an area for deductions. To add a deduction, click "+ Add"

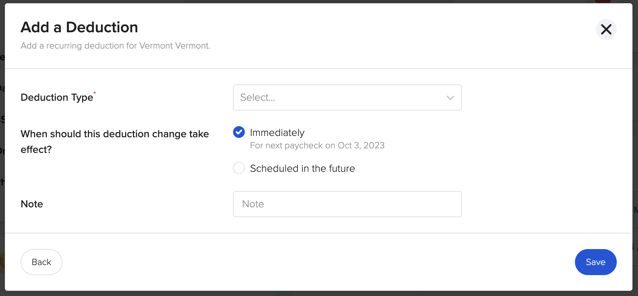

- A pop-up will appear and you will need to fill out the following:

- Deduction Type: select the type of deduction you are adding (for more information on the fields included in deduction types, please click here).

- Deduction Amount: you have two options - a flat dollar amount or a % of wages

- 🌟 Hint: if you are entering a % value, you need to format it as a whole number, not a decimal. (ie. for 3%, you would enter "3", not ".03")

- When do you want the deduction to take effect:

- Immediately: this deduction would take effect immediately and you would see it on the upcoming paycheck

- In the future: this deduction would take effect per the effective date you selected

- Click save and you are done 🎉

Deduction Type:

Loan repayment options

When it comes to loan repayment options, you have a choice of 5 different options to consider.

- 401(k) Loan Repayment

- Roth 401k) Loan Repayment

- 403(b) Loan Repayment

- Roth 403(b) Loan Repayment

- IRA Loan Repayment

When selecting any one of these options you will need to fill out the following:

- Deduction Amount: you have two options - a flat dollar amount or a % of wages

- Total Amount Owed

-

When should this deduction change take effect?

- A Note if applicable

Additional Deduction types

- 401(k)

- Roth 401(K)

- 403(b)

- Roth 403(b)

- SIMPLE IRA

- SEP IRA

When selecting any one of these options you will need to fill out the following:

- Deduction Amount: you have two options - a flat dollar amount or a % of wages

- Annual Deduction Limit

- Standard Limit: set at $23,00 by the IRS 2024

- Catch-Up Limit: set at $30,500 by the IRS for 2024, employees 50 yrs old + are eligible

- Company Contribution: should this deduction have a company match? If not, select "No Contribution". Please note that you cannot enter $0 in this field if toggled on.

- When do you want the deduction to take effect:

- Immediately: this deduction would take effect immediately and you would see it on the upcoming paycheck

- In the future: this deduction would take effect per the effective date you selected

Match Options

| Scenario: Employer matched up to 3% | Contribution Type | Deduction Type (% entered in ER match) |

| EE contributes to both 1% Traditional and 1% Roth | Gross % of Wages | Traditional (2%) Roth (No Contribution) |

| EE contributes to only 1% Traditional | Gross % of Wages | Traditional (1%) |

| EE contributes to only 1% Roth | Gross % of Wages | Roth (1%) |

Frequently Asked Questions:

Who can add/edit offline deductions?

Currently, only an admin with full access to GoCo can add, edit, or remove offline deductions in GoCo. If you see a deduction that looks wrong or you want to change, reach out to your admin!

Why do some deductions show a "lock" symbol?

If you see a lock symbol next to a deduction, that means one of two things:

- The deduction is being fed from your benefits in GoCo, and therefore cannot be edited. If the deduction value seems wrong, it could have to do with how your benefits are configured. Please reach out to your admin or dedicated GoCo CSM.

Can I add a limit or cap to an offline deduction?

Currently, you cannot add a cap to an offline deduction in GoCo.

I don't see the deduction type I need to add, what do I do next?

In order to add a new deduction code, you will need to reach out to your GoCo Payroll Specialist. Once they add it on their end, it will show up in GoCo on the next day.

What about garnishments? Can we add those as offline deductions?

All garnishments must be sent with documentation to your Payroll Specialist at GoCo.

Can I mass import offline deductions?

At this time, there is no import option for adding offline deductions.

Can I run a report on all offline deductions that are in employees' profiles?

Yes! Those field names are available when you build custom reports in GoCo.

To learn more about recurring earnings/ deductions click here!

Have additional questions? Email us at help@goco.io 💚

Updated 7.1.2024