How to enable the Human Interest Integration with Gusto

A Guide to Seamlessly Integrate Human Interest with Gusto

Managing the election and funding of retirement accounts is an important administrative task for HR professionals. GoCo and Human Interest have partnered to offer a 360° 401(k) sync for embedded payroll customers that makes the task hands-off and worry-free by streamlining the payroll processes and ensuring that retirement accounts are funded consistently and accurately.

To set up the Human interest Integration please reach out to your client success team!

With our Human Interest integration:

-

GoCo will send Human Interest demographic data.

-

Human Interest uses this data to manage team member eligibility.

-

-

Human Interest will send GoCo member retirement deferral elections.

-

GoCo uses this data to ensure the deductions made in payroll match what your team members' elect in Human Interest.

-

-

GoCo will send Human Interest payroll data to fund Human Interest 401(k) accounts.

-

Human Interest uses this data to ensure your team members' accounts are funded based on what was deducted from payroll.

-

-

GoCo will send Human Interest a year-to-date funding report from payroll.

-

Human Interest uses this data to ensure accurate funding and keep your company and team members' compliant with retirement funding regulations.

-

Configuring Company Contributions

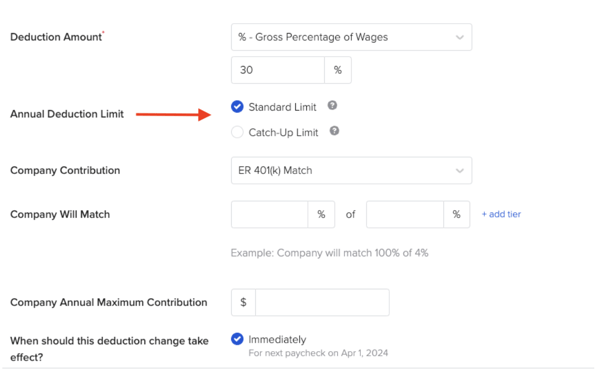

When deciding whether a company will contribute to retirement plans, Gusto embedded payroll users can choose from options to establish company matching rules, which may include additional tiers for contributions. They'll also be able to add a Company Annual Maximum Contribution.

Annual Deduction Limit

Users will be able to view a section labeled "Annual Deduction Limit". This feature is set as read-only and configured through the Human Interest platform.

- Standard limit: limit is set at $23,000 by the IRS for 2024.

-

Catch-up limit: limit is set at $30,500 by the IRS for 2024; Employees 50 years old or older are eligible for the catch-up limit.

Loans

Adjust your loan payment amounts by a flat dollar amount or percentage by gross wages. The "Total Amount Owed" can be configured in the Human Interest platform

If you have Human Interest related questions check out their resource center

If you have additional questions please contact your Client Success Team or email us at support@goco.io 💚