Understanding GoCo's Embedded Payroll Communications: Critical & Non-Critical Alerts for Full Access Admins

A guide to the email and notification alerts admins will receive, their meanings, and recommended actions.

As a Full Access Admin using GoCo's embedded payroll system, you will receive notifications to alert you to important actions that require your attention. These notifications are categorized into two types: critical and non-critical.

This guide will help you understand the meaning of each type of notification and provide actionable steps to address any issues that arise.

Jump to Non-Critical Notifications

Critical Communications

📌 All Critical Communications will be sent to you, the Full Access Admin, via email AND a GoCo notification. Admins cannot opt out of these notification types.

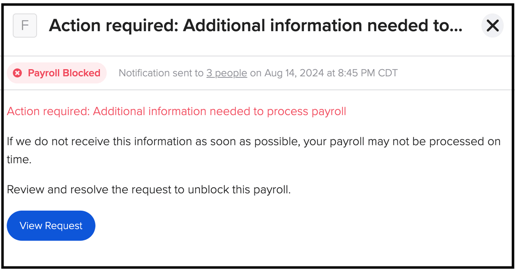

Information Requests Notification

Reason: Embedded Payroll's risk team determines that there is additional company information that needs to be collected before the company can be approved (or payroll can be processed).

Recommended Action:

-

You will be able to resolve the information request directly in GoCo by clicking "View Request" failure to complete the information request timely will result in delayed payroll processing.

-

There are two information request types: Company Onboarding (only occurs when implementing payroll) and Payroll Processing (post payroll submission, need to verify bank balance).

Email sample:

Inbox sample:

Embedded Payroll Education

Reason: When you are setting up an account, GoCo may reach out to request additional documentation, as payroll must remain compliant with banking and financial institution regulations. The additional information helps verify your identity and make sure your account is secure.

Failing to respond to the information requests will prevent you from completing the onboarding of their company—they will not be able to process payroll until a response is received.

Recommended Action Solution:

-

Please respond to the information request, the GoCo team will review the information they provide within 1 business day and follow up with any additional questions if necessary.

📌 Common documents GoCo might request for this request

-

Photo of company signatory’s driver's license or ID card: We need this to verify identity. You can take a photo and upload it using a smartphone or camera.

Upcoming Debit for Tax Reconciliations Notification

Reason: A tax reconciliation was ran, resulting in money owed. Payroll is going to debit the company's bank account for the balance owed.

Recommended Action:

-

This alert is a courtesy so you (a) know what a specific transaction is for and (b) can ensure there is enough money in the account to fund the debit.

Inbox sample:

State Tax Issues Notification

Reason: Issues with the tax information provided are blocking payroll.

Recommended Action:

-

You will be fully responsible for ensuring their state tax setup is complete and accurate. When this notification occurs, you will be able to access their state tax info directly in GoCo. If you need an extension, you can ask the GoCo team (as failure to meet the deadline will block their ability to run payroll).

Email sample:

Inbox sample:

Recover Cases Notification

Reason: There are insufficient employer balances, frozen bank accounts, and debit failures.

Recommended Action:

-

Although uncommon, if this occurs, you will be notified and can completely unblock and resolve the recovery case. Failure to complete the information request will result in delayed payroll processing.

Email sample:

Inbox sample:

Employee Direct Deposit Failed Notification

Reason: You selected to pay an employee via direct deposit, but the payroll system switched the payment method to a paper check.

Recommended Action:

- If an employee changes their banking info in the middle of processing OR there are failed re-debit attempts, Payroll will refund the money back to the employer for you to issue payment in-house.

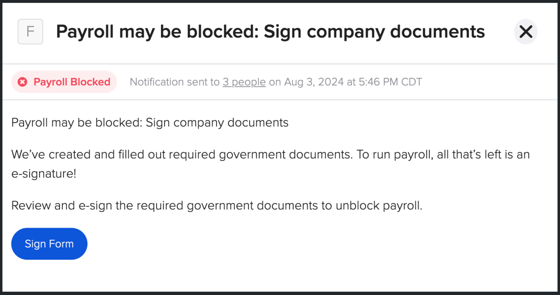

Company Signature Required Notification

Reason: The signatory for your company will need to sign paperwork before payroll can be processed.

Recommended Action:

This is common post-implementation after a company registers with a new state. Typically your company will need to grant TPA rights for GoCo Embedded Payroll to file taxes on your behalf.Inbox sample:

Non-Critical Communications: Items that will create a notification to all Full-Access Admins

Failed Deposit Notification

Reason: A transaction for the employee /contractor bank account was unsuccessful

Recommended Action:

-

You can expect this on two occasions and can resolve/reattempt the credit by updating payment details via the employee profile in GoCo.

-

Pre-note Failures: Every time an employee changes their banking information, payroll will attempt to validate it with a tiny deposit (.01).

-

Payment Failures: When an employee is paid via payroll, payroll will attempt to credit the employee's bank account for their Net Pay.

- Please Note: Payment Failures will also appear as "needs review" on the pay run.

-

The purpose of this "needs review" here is to allow you the opportunity to verify and connect with the employee that their payment details have been updated

-

-

Employee/ Contractor Reversal Failed Notification

Reason: Due to a bank error, payroll was unable to debit funds to the employee's bank account.

Recommended Action:

-

This would only apply if there was a reverse request and a payment was made to an employee. GoCo can initiate a reversal within a small window, and if it is unsuccessful, the company would need to recollect funds in another way.

Inbox sample:

State Tax Issues Notification

- You can review and resolve the information request directly in GoCo. Failure to complete the information request timely could result in failed form filings and/or a critical notification (which leads to blocked payroll).

Inbox sample:

Employee SSN Verification Failed Notification

-

Although uncommon, you the admin, will be required to correct the SSN before paying said employee.

- Please Note: This non-critical item will also appear as "needs review" on the pay run.

-

Clear the error, you cannot process payroll without clearing this error.

-

Verify Employee Work Location Notification

Reason: Distance between home and work address exceeds maximum miles (100 miles)

Recommended Action:

-

This is a courtesy notification that asks you to verify that the employee's designated work location is correct. You can choose to change it or ignore it. Regardless, we will only tell you once (this will get re-triggered if there is a change in work location/home address).

Inbox sample: