GoCo supports international work locations and currency. Here is everything you need to know about how to set these up in GoCo.

Adding an employee with an international currency:

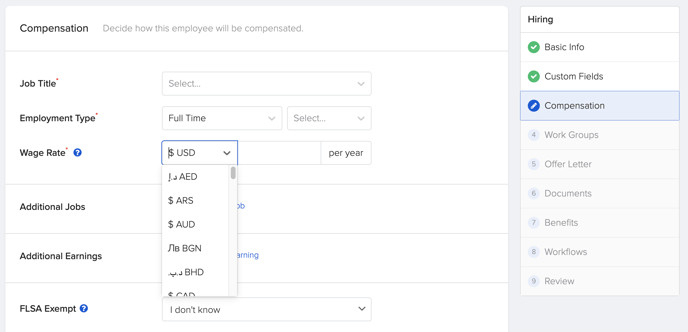

- Using the normal hiring wizard on the Team page, click + Add Person > Employee

- On the third page, Compensation, you will notice a drop-down box next to the salary or hourly rate:

- Once you've chosen the currency type (GoCo supports most currency types including AUD, MXN, etc.) enter the amount and continue through the hiring wizard.

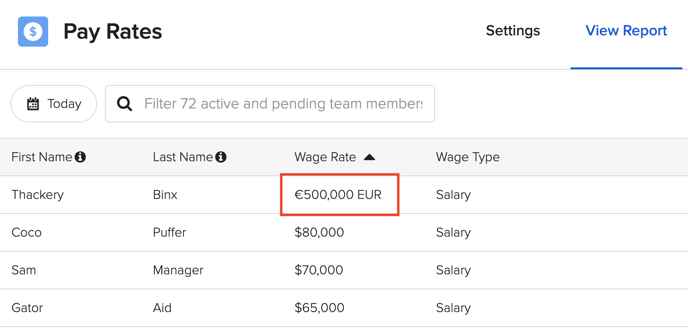

When reporting on wage rates, you will notice the symbol of the currency at the front of the amount:

⚠️Note: Salary-based benefits will be based on $0 USD.

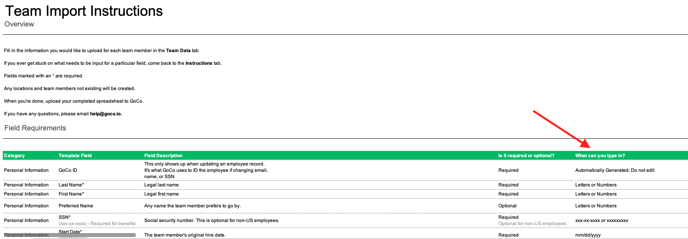

Importing an employee with international currency:

When you download the import template you will notice the Annual Base Salary and Hourly Rate columns. Make sure to follow the instructions on the first tab of the import on how to enter international currencies.

A correct format would look like this: "5,000 RUP"

An incorrect format would look like this: "€50,000"

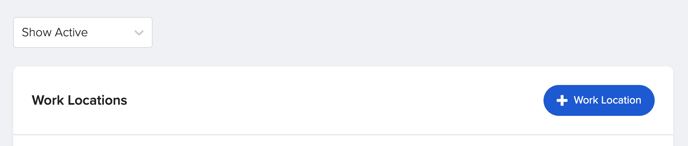

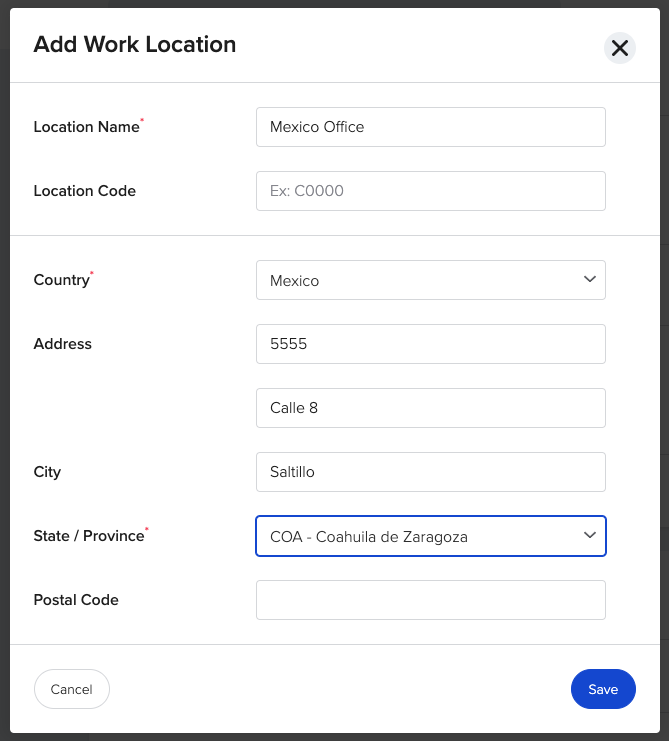

Adding an international work location:

- From your company page, you will notice a Workgroups module located at the bottom left-hand side of the page. Click on the View button.

- A list of any existing locations will be displayed. To add a new location, click on the + Add Work Location button located below the list. Note: To edit an existing Location, click on the more options icon (Three Dots) located to the far right.

- A pop-up window will appear that will allow you to input the location address. Click Save to save changes.

4. All Done! Easy as riding a bike!

Employees & International Work Locations:

Adding a new employee that works internationally is almost identical to hiring a regular employee. Here are a few exceptions:

1. Work Location: You will need to already have an international work location setup in GoCo (see above on how to add this). During the new hire wizard, select the international work location that applies to the employee.

2. US-Specific Forms: After assigning an employee to an international location, GoCo will automatically exclude W-4, I-9, and State Withholding forms from being assigned to the employee. If you need to send these to the employees, you will have to manually add them either through the new hire wizard or through the employee's profile directly.

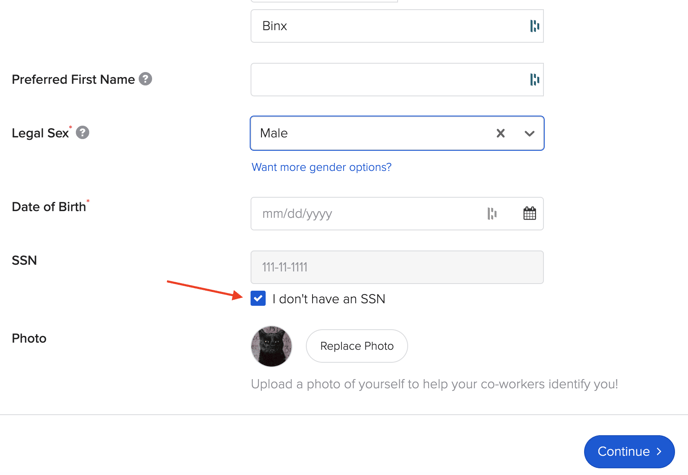

3. Employee On-boarding: When the employee is asked to onboard with GoCo, everything will look and feel the same with the exception of their SSN or Tax ID number. Employees assigned to international locations will now have the option to check off a box ("I don't have an SSN") that allows them to bypass this step.

If you have an existing employee that you need to update to an international location, it is going to be the same as if you were simply updating their work location!

We hope this helps with most of your questions regarding international work locations. As always, please contact help@goco.io if you have any additional questions we can answer!