How to Create a Custom Report To Verify W-4 Exemption Status: EOY Payroll Reporting

To ensure every employee has a W-4 filing status, keep reading on how to report!

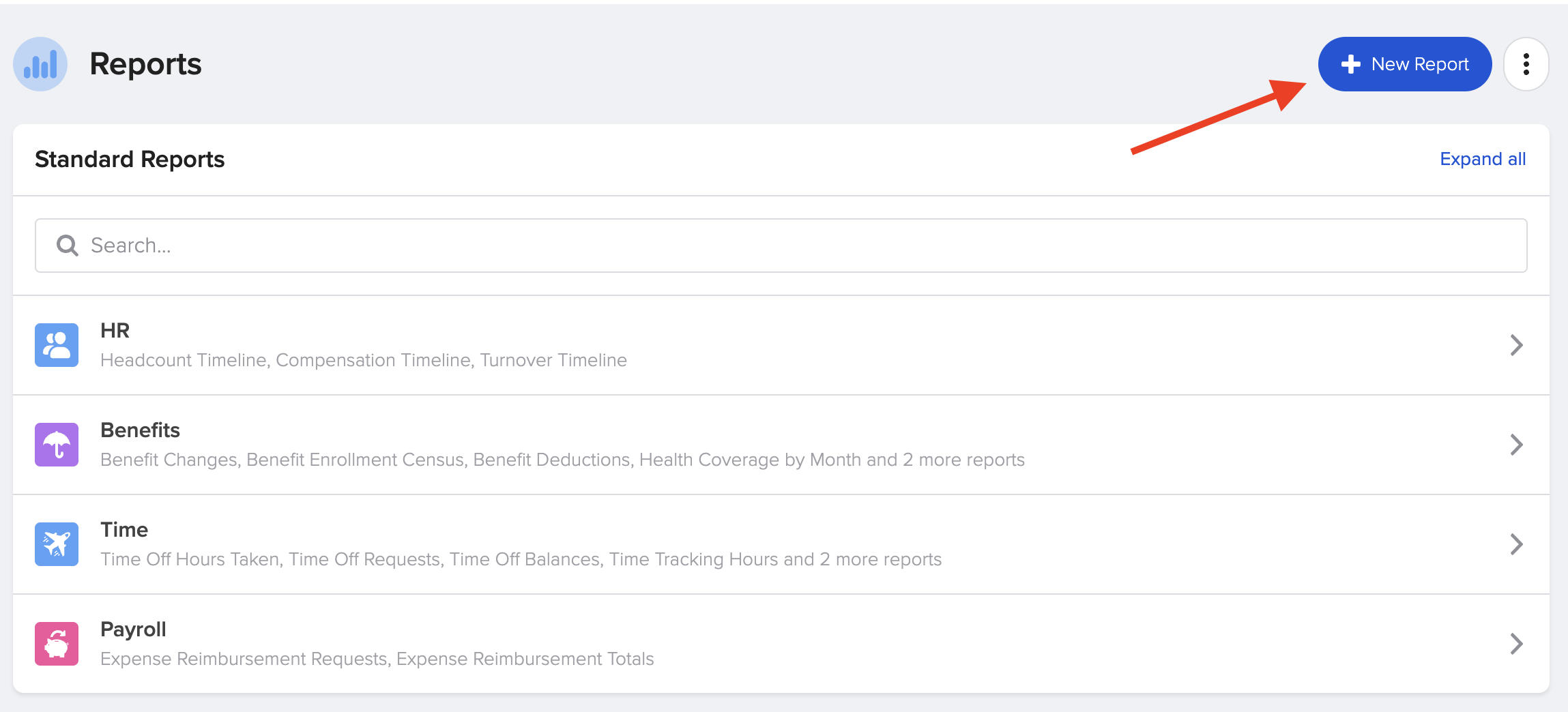

Navigate to Reports > Create New Report (top right)

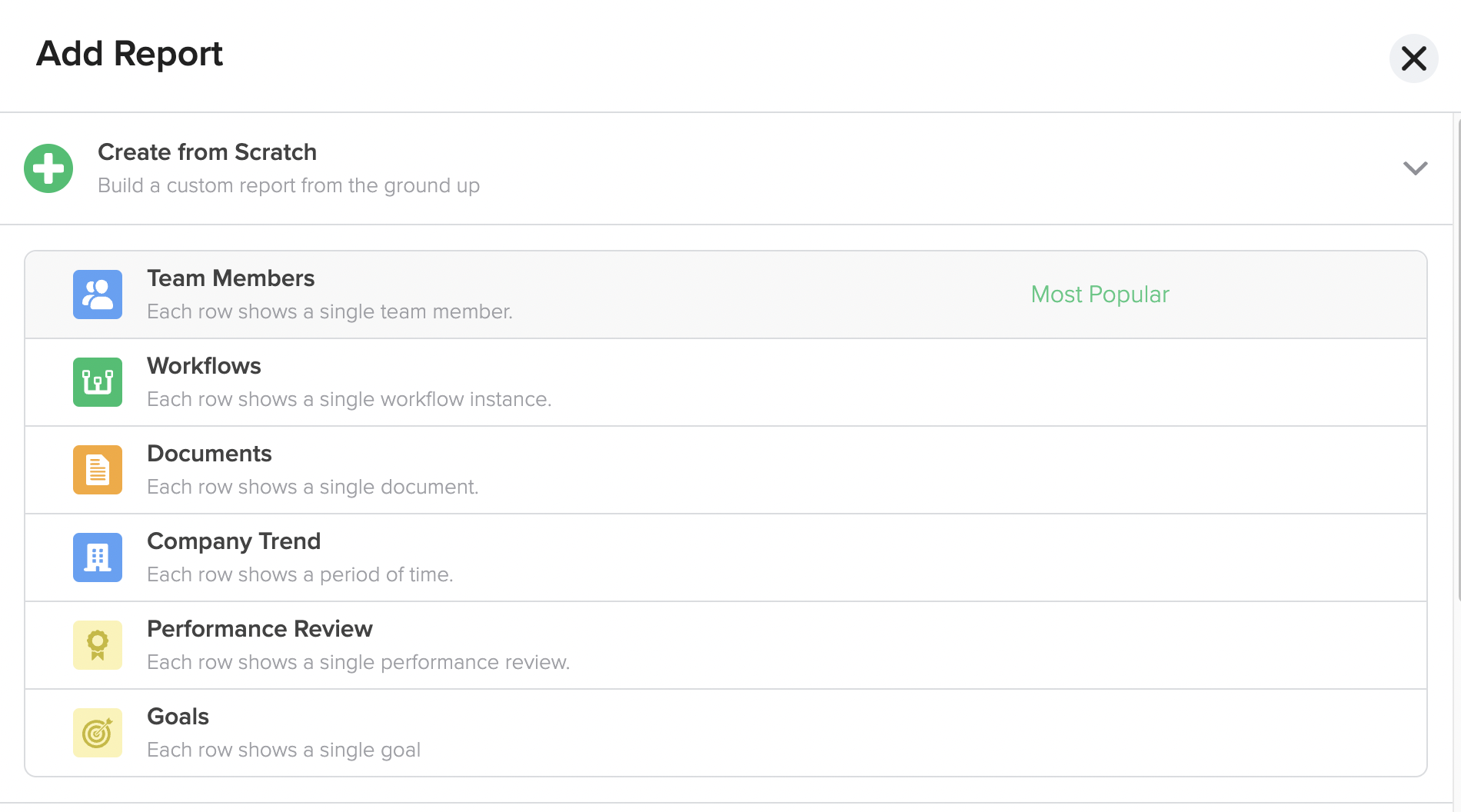

Create from Scratch > Team Members

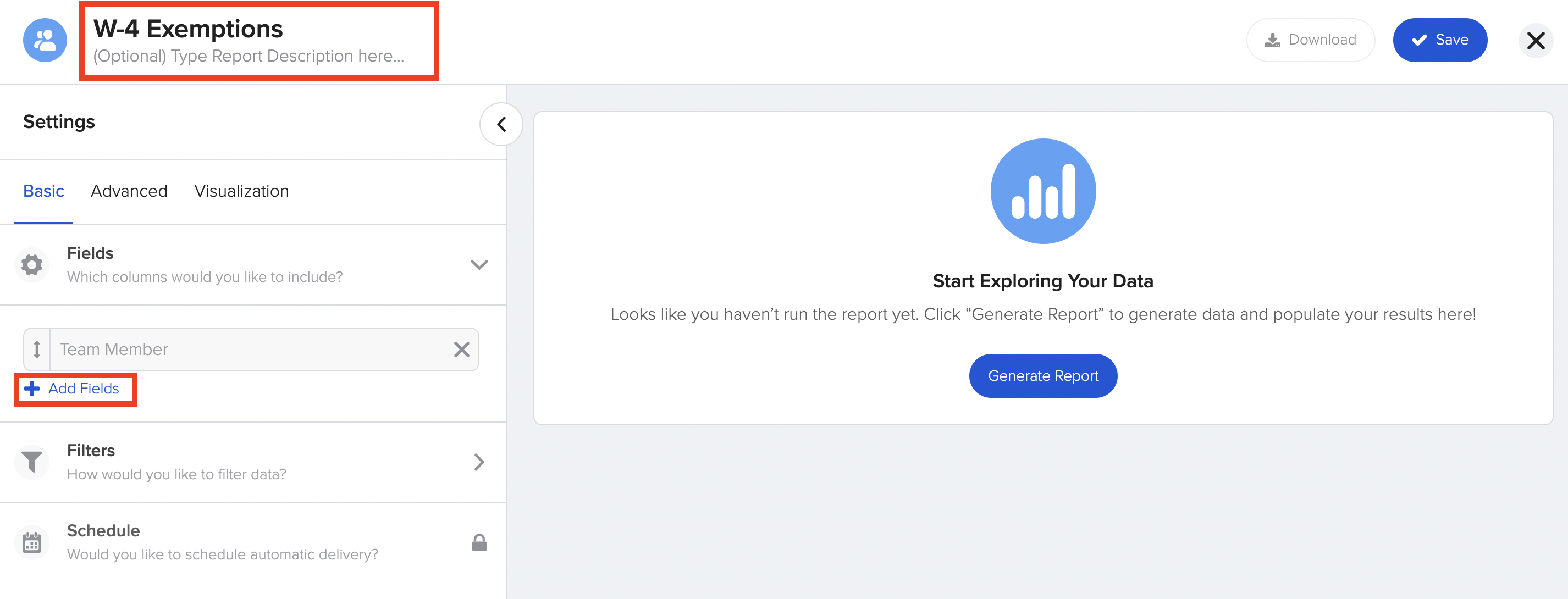

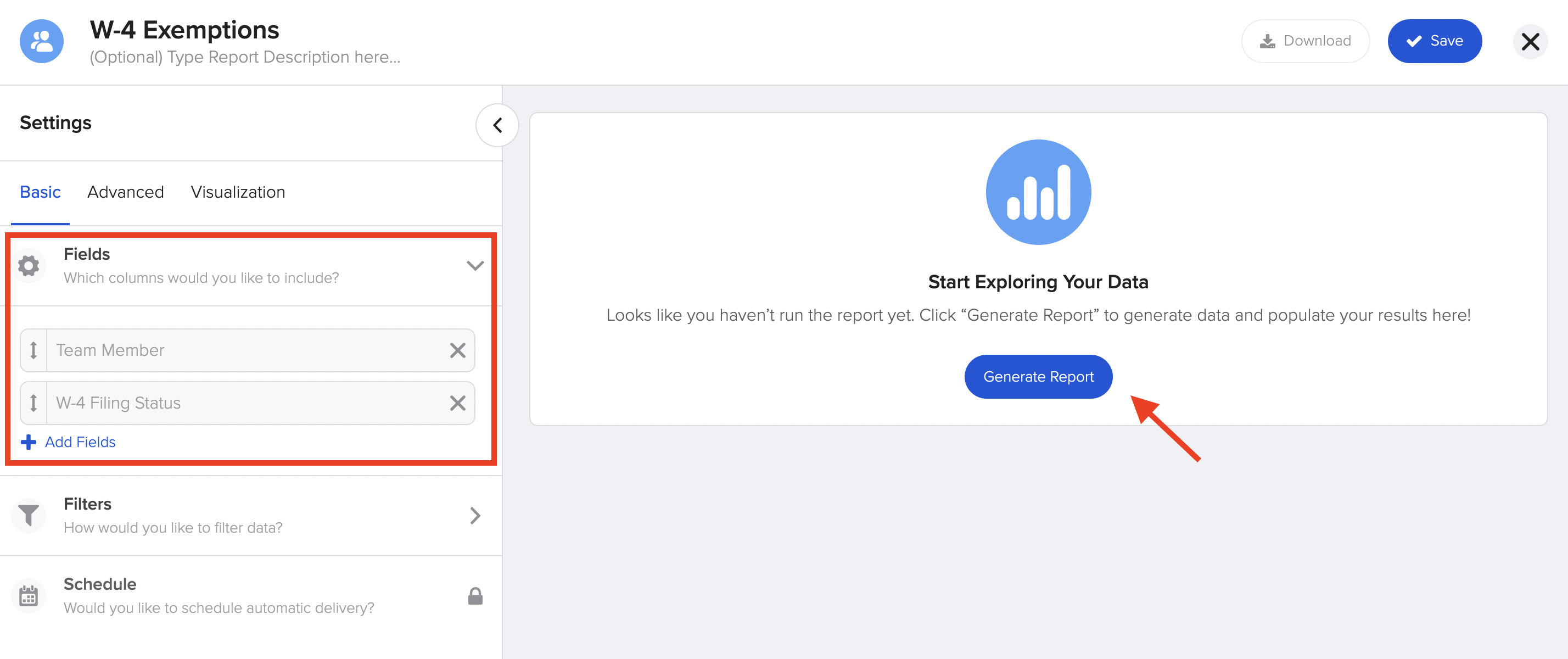

Name your report so you can use the template next year and under Fields, select + Add Fields

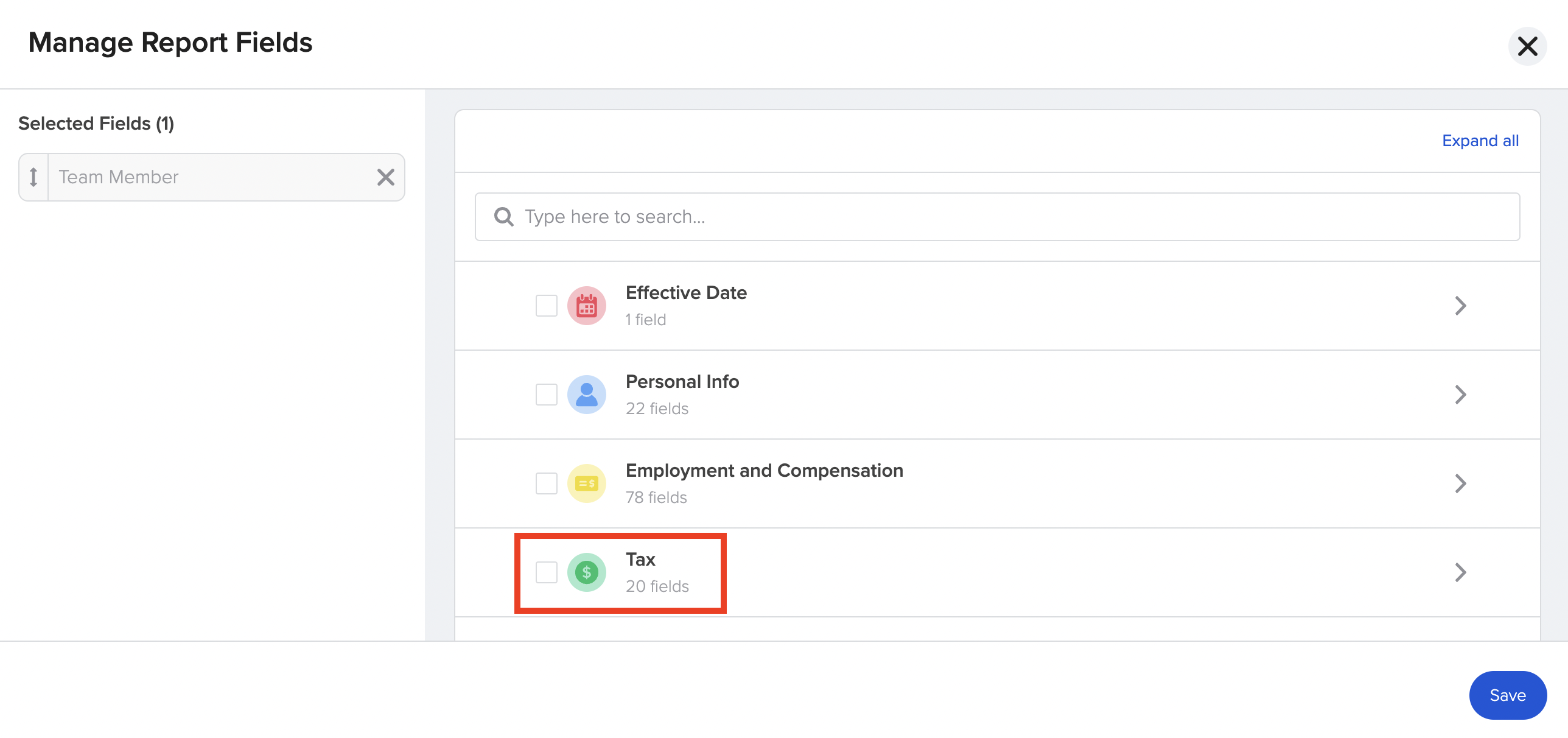

Scroll down to the Tax field and you can either select all 20 default options (includes W-4 and state taxes) by checking the box or you can click into the tax field and pick and choose the fields you would like to see.

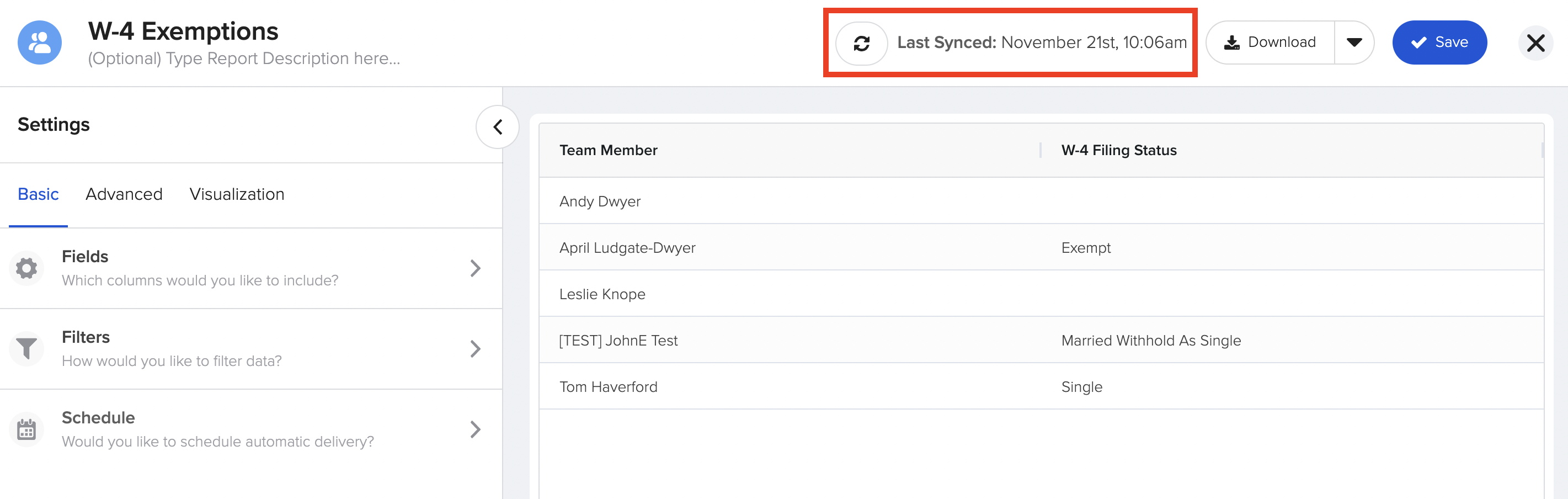

Ensure W-4 Filing Status is selected and then Generate Report.

This report will give you a quick overview of your employee W-4 status'! If the employee does not have a selection, that means they have not yet completed onboarding or when they onboarded in GoCo, federal taxes were not asked to be completed via the hiring workflow. If you feel as though the employee should have completed their W-4 filing status, please reach out directly to the employee and have them log in to GoCo to update.